Types of Commercial Loans

Commercial loans can be structured as business term loans or lines of credit, depending on the specific needs of the business. Business term loans are a common option, providing a lump sum of funds that businesses can use for various purposes, such as financing projects or expansion plans. On the other hand, lines of credit offer more flexibility, allowing businesses to access funds as needed and only pay interest on the amount used.

Collateral and Cash Flows

When applying for a commercial loan, collateral is often required to secure the loan. This collateral can be in the form of assets owned by the business or cash flows from future accounts receivable. By providing collateral, businesses demonstrate their commitment to repaying the loan, giving the lender a sense of security.

Documentation and Application Process

To apply for a commercial loan, businesses need to provide various documents that demonstrate their financial stability and ability to repay the loan. These may include balance sheets, income statements, and cash flow statements. Additionally, lenders may require insurance on any purchased items.

The application process itself can vary depending on the lender and the specific loan program. It typically involves submitting the necessary documentation, completing the application form, and waiting for approval. The approval time can range from a few days to several weeks, depending on the complexity of the loan and the lender’s internal processes.

Commercial Loan Application Requirements

By fulfilling all the necessary requirements and providing the required documentation, businesses increase their chances of securing a commercial loan to support their growth and operational needs.

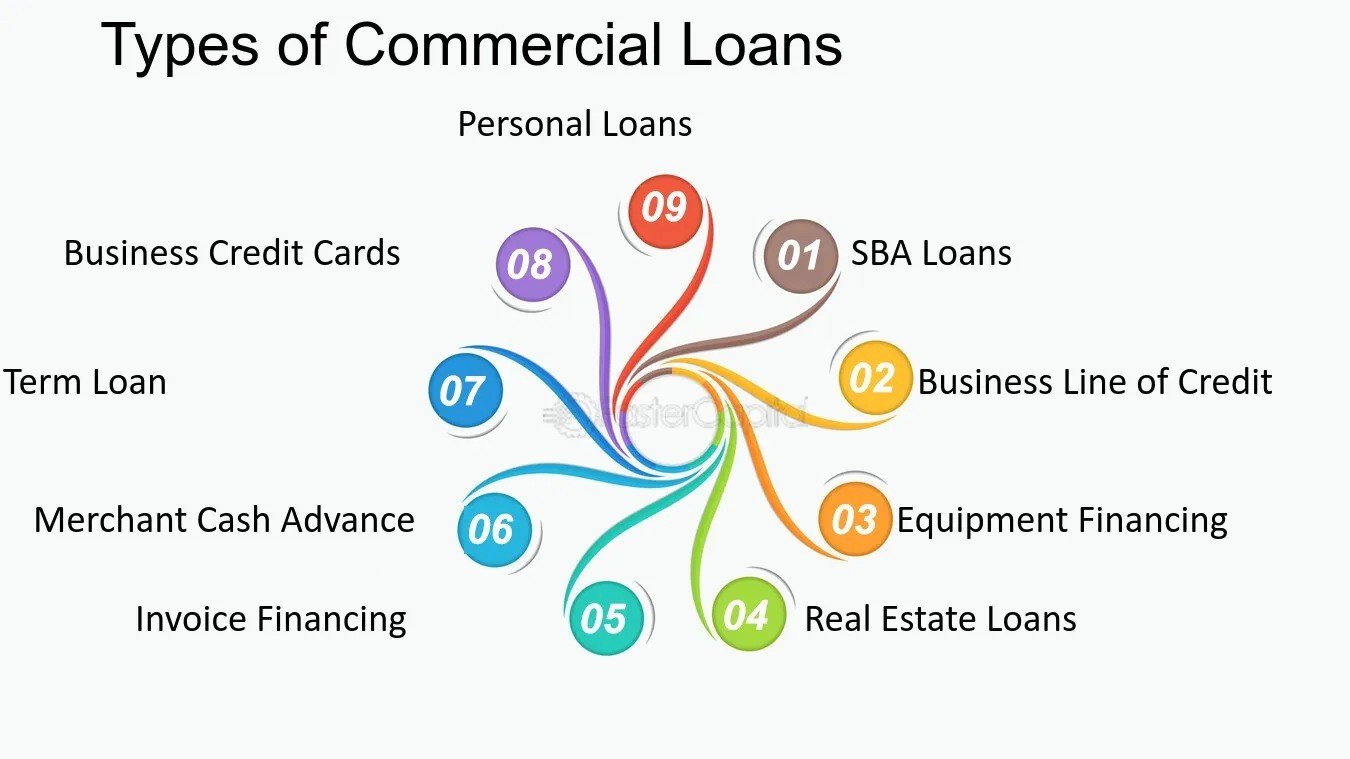

Types of Commercial Loans

Commercial loans come in various forms to cater to different business needs. Whether you require funding for real estate ventures, equipment purchases, or short-term financing, there is a type of commercial loan that can suit your specific requirements. Let’s explore some of the common types of commercial loans:

- Mini-Perm Loans for Commercial Real Estate: These loans are designed for commercial real estate projects and provide financing during the construction or development phase. They offer flexibility with repayment terms and typically have a duration of three to five years.

- Renewable Loans for Ongoing Operations: These loans are suitable for businesses that require continuous funding for their day-to-day operations. They provide a revolving line of credit that can be accessed on an ongoing basis.

- Equipment Financing Loans: Businesses that need to purchase specialized equipment can opt for equipment financing loans. These loans enable businesses to acquire the necessary equipment while spreading out the cost over time.

- Commercial Auto Loans: If your business requires vehicles for transportation or delivery purposes, commercial auto loans can be a suitable option. These loans provide financing to purchase commercial vehicles and offer customized repayment terms.

- Commercial Bridge Loans: Designed for short-term financing, commercial bridge loans help businesses bridge the gap between transactions or financing. These loans are commonly used in commercial real estate to facilitate quick transactions while waiting for long-term financing.

Understanding the different types of commercial loans available can help businesses make informed decisions when seeking financial support. By choosing the right type of loan, businesses can secure the necessary funds to drive growth and achieve their goals.

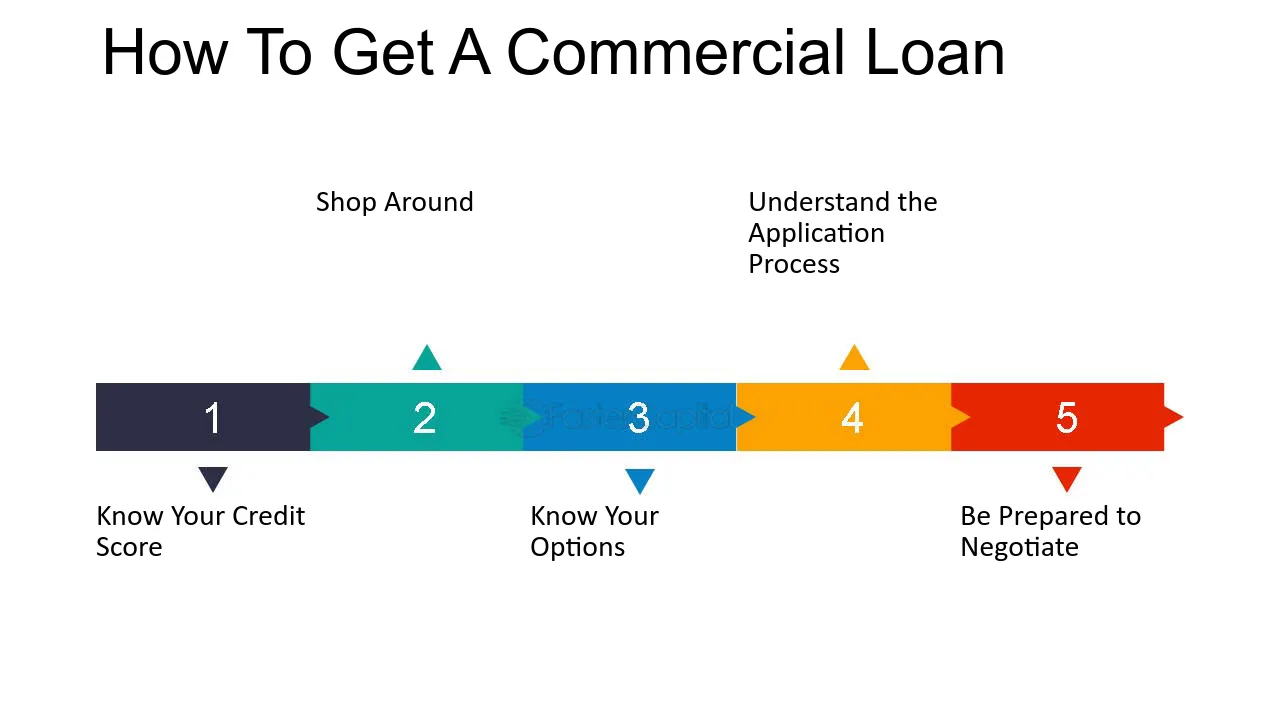

How to Get a Commercial Loan

Commercial loans come in various forms to cater to different business needs. Whether you require funding for real estate ventures, equipment purchases, or short-term financing, there is a type of commercial loan that can suit your specific requirements. Let’s explore some of the common types of commercial loans:

- Mini-Perm Loans for Commercial Real Estate: These loans are designed for commercial real estate projects and provide financing during the construction or development phase. They offer flexibility with repayment terms and typically have a duration of three to five years.

- Renewable Loans for Ongoing Operations: These loans are suitable for businesses that require continuous funding for their day-to-day operations. They provide a revolving line of credit that can be accessed on an ongoing basis.

- Equipment Financing Loans: Businesses that need to purchase specialized equipment can opt for equipment financing loans. These loans enable businesses to acquire the necessary equipment while spreading out the cost over time.

- Commercial Auto Loans: If your business requires vehicles for transportation or delivery purposes, commercial auto loans can be a suitable option. These loans provide financing to purchase commercial vehicles and offer customized repayment terms.

- Commercial Bridge Loans: Designed for short-term financing, commercial bridge loans help businesses bridge the gap between transactions or financing. These loans are commonly used in commercial real estate to facilitate quick transactions while waiting for long-term financing.

Understanding the different types of commercial loans available can help businesses make informed decisions when seeking financial support. By choosing the right type of loan, businesses can secure the necessary funds to drive growth and achieve their goals.

How to Get a Commercial Loan

When it comes to obtaining a commercial loan, businesses have several options to choose from. The choice of lender depends on factors such as cost, funding time, and business qualifications. Here are some common sources where businesses can secure a commercial loan:

- Banks and Credit Unions: Banks and credit unions are traditional lenders that offer commercial loans. They typically provide lower interest rates but have longer application processes. Businesses looking for competitive rates and personalized service may opt for these institutions.

- U.S. Small Business Administration (SBA): The SBA works with lenders to offer commercial loans to small businesses. SBA loans often come with favorable terms and rates, making them an attractive option for business owners seeking financial assistance.

- Online Lenders: Online lenders provide a quick and convenient way to access funds. These lenders offer faster approval processes but may have higher interest rates compared to traditional institutions. Business owners requiring immediate funding or with less-than-perfect credit may find online lenders to be a viable solution.

- Nonprofit Lenders: Nonprofit lenders are organizations that focus on supporting local communities. They offer a range of loan products tailored to meet the needs of small businesses. These lenders often prioritize community impact and provide flexible financing options.

Each lending option has its own advantages and disadvantages. It’s important for businesses to carefully consider their financial goals and choose a lender that aligns with their needs and capabilities.